–News Direct–

By Faith Ashmore, Benzinga

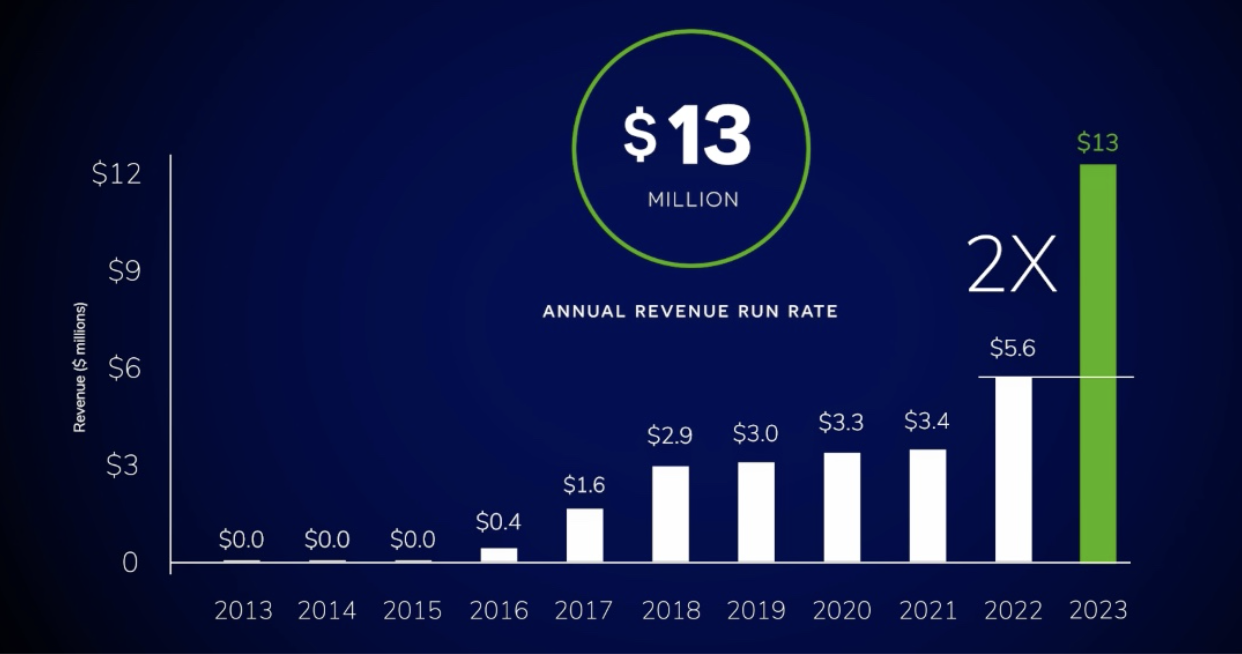

Knightscope (NASDAQ: KSCP), a technology company ushering in the dawn of Autonomous Security Robots (ASRs), is entering 2024 after what it reports was a successful 2023; the companys 10th year in business. Founded in 2013, Knightscope anticipated the growth of AI and robotics and got into the space early, setting the company on a path toward becoming a major player.

Knightscopes record has garnered attention across the nation. The company has consistently increased its revenue; in 2021 it reached $3.4 million, followed by $5.6 million in 2022, and the company believes the final amount for 2023 reached between $12-13 million in growth. Once confirmed, the company will have demonstrated consistent growth.

One of the companys most notable achievements in 2023 was its partnership with the NYPD, which placed its ASRs in the New York City subway system. However, Knightscopes high-profile partnership with the NYPD is only part of the companys success as interest grows in using ASRs to increase public safety. In 2023, Knightscope expanded into various industries including commercial real estate, universities, healthcare and casinos, among others.

In the fall of 2023, a California community college invested over $1.5 billion in updating its facilities, including its safety and security measures. Knightscope was chosen as the vendor to replace the college's outdated emergency phone system with K1 Blue Light Towers. Now, the college has installed a total of 26 Towers and is adding six more to enhance its operations. Knightscope has also made strides in hospitality they have secured contracts with hotels in Portland, Oregon, where their K5 Autonomous Security Robots will patrol the parking areas to ensure the safety of guests, employees and visitors.

Last year saw more casinos partner with Knightscope; two casinos in Louisiana, located in Shreveport and Bossier City signed contracts to utilize Knightscope's K5 ASRs, making it the first ASR contract in the state. Those contracts added to ASRs already deployed in Nevada, Iowa, Illinois and California. The K5 ASR has been welcomed in the casino space as it greets guests with a friendly voice and provides an additional set of eyes and ears for the human security team.

The companys recent announcement of receiving its Authority to Operate (ATO) from the Federal Risk and Authorization Management Program (FedeRAMP), opens the door, the company believes, to billions in increase to its TAM (Total Addressable Market). The first deployment is planned with the U.S. Department of Veterans Affairs.

While the company has a proven track record of signing new contracts and expanding its reach with new clients, it has also demonstrated that existing clients stay on board and extend their contracts, given that multiple clients of the company renewed their contracts in 2023, including a Fortune 500 company. The robotics market was valued at $31.38 billion in 2021 and is expected to reach $110.39 by 2030, with a CAGR of 15% from 2022-2030. Knightscope seems well-positioned to capitalize on this growth and continue to increase its consumer base.

Click here to read more about the companys future plans from CEO William Santana Li.

Featured photo courtesy of Knightscope.

Benzinga is a leading financial media and data provider, known for delivering accurate, timely, and actionable financial information to empower investors and traders.

This post contains sponsored content. This content is for informational purposes only and not intended to be investing advice.

AN OFFERING STATEMENT REGARDING THIS OFFERING HAS BEEN FILED WITH THE SEC. THE SEC HAS QUALIFIED THAT OFFERING STATEMENT, WHICH ONLY MEANS THAT THE COMPANY MAY MAKE SALES OF THE SECURITIES DESCRIBED BY THE OFFERING STATEMENT. THE OFFERING CIRCULAR THAT IS PART OF THAT OFFERING STATEMENT IS AVAILABLE HERE.

Contact Details

Benzinga

+1 877-440-9464

Company Website

View source version on newsdirect.com: https://newsdirect.com/news/knightscope-nasdaq-kscp-is-making-a-splash-in-the-robotic-industry-with-revenue-increases-year-over-year-643409293

Benzinga

COMTEX_449126925/2655/2024-03-12T08:36:33